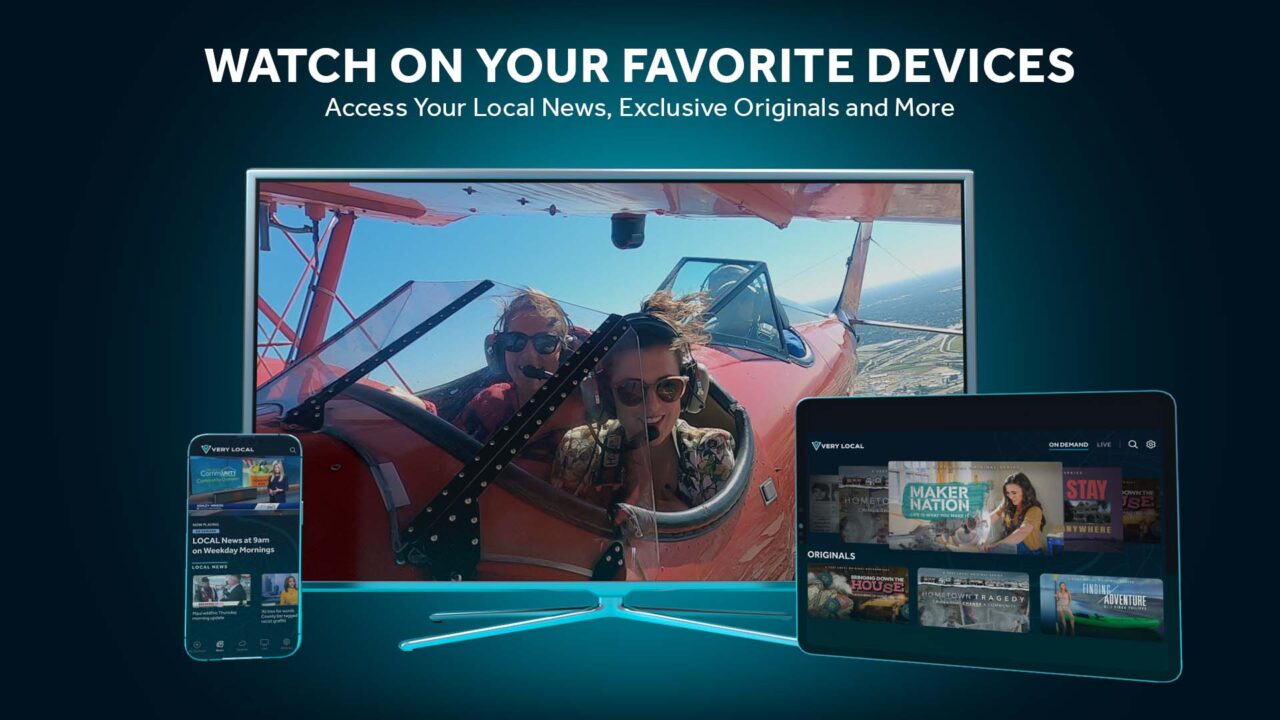

Very Local New Orleans

News & weather from WDSU, plus new Very Local series all about New Orleans.

Stream Local News & Weather

Stay in the know with the latest New Orleans news, weather and stories from WDSU. Download the Very Local app to stream everything for free.